For the last two weeks, and through the efforts of the “Citizens Right To Vote On Tax Increase Committee,” concerned property owners of Trigg County have marched into the old Economy CeeBee No. 2 building and signed the dotted line, asking for a special-called referendum and vote against the school’s proposed and unanimously approved “nickel tax.”

As of Tuesday afternoon, more than 1,000 signatures had been collected — with just a shade over 740 needed and authorized by County Clerk Carmen Finley to make it so.

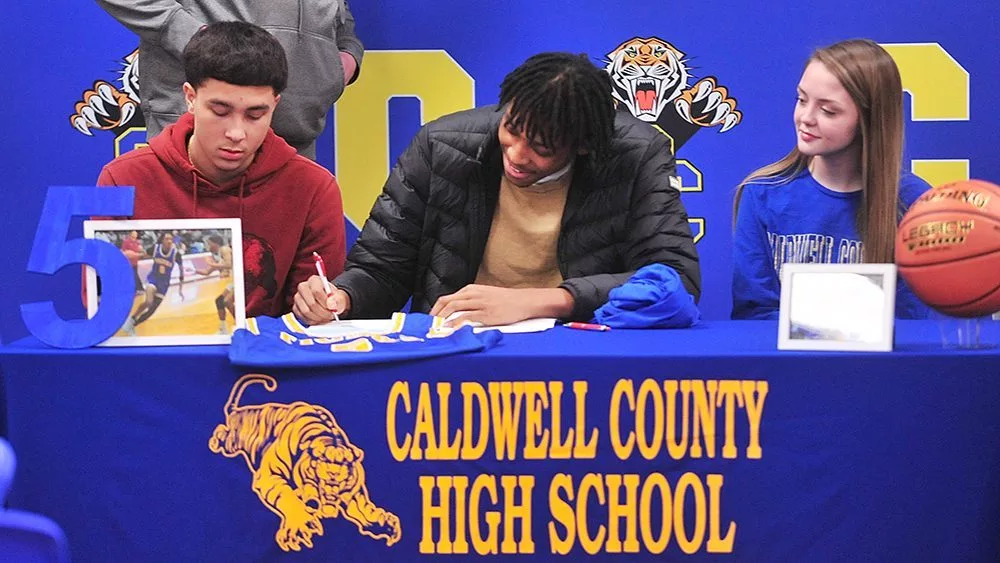

Earl Wade, a 1980 graduate of Caldwell County High School and local resident, serves as media spokesman for the committee’s efforts. At a scheduled 5 PM meeting Tuesday, he said he would be recommending the collection of signatures end, and following verification and legibility efforts, the list would be submitted to Finley perhaps as early as next Monday.

Wade said that one of the biggest concerns from constituents hasn’t necessarily been the idea of more taxes, but the method in which this tax conversation came to be.

While votes in both Christian County and Crittenden County have thwarted nickel tax initiatives in recent years, Wade noted that efforts to contact knowledgeable folks on citizen response came after the fact.

On multiple signature sheets in the building, it states that school property taxes will equal more than 11%, when in actuality, it’s going to be closer to 6% total if implemented and collected.

Trigg County officials have repeatedly stated that the recallable nickel would be used alongside paired and bequeathed funding from the state’s SEEK stockpile to increase the district’s bonding potential for renovations to the high school, home of the Wildcats. The building, constructed in 1962, has shown signs of disrepair and needs a lift.

Wade said that a current frustration from himself and many signees is a perceived mismanagement of building funds — especially with the current construction of a multi-purpose facility being constructed between Perdue Field and Trigg County Middle School.

So, is there a better way to have both this multi-purpose building, and a repair of the high school? Wade said it’s a matter of wants versus needs.

Wade said another concern that’s come from signees and interested local parties is the notion that Trigg County’s academic benchmarks should be higher before considering school repairs.

While the multi-purpose facility does continue to draw the ire of some, multiple Trigg Schools administrators have indicated that a lack of space for certain campus fixtures has become a problem, and that rental space is neither affordable nor available. Furthermore, the multi-purpose facility is providing bathrooms for that part of campus.

So, what if Trigg County’s officials eventually decided on building a new high school altogether? Would local community members be more apt to accept that a nickel tax could build anew, say along US 68/80, rather than repair the old? Wouldn’t that allow for the primary, intermediate and middle schools expand around the soon-to-be renovated vocational school?

There’s one giant roadblock in the way of this becoming a sincere possibility: the exorbitant cost of a second cafeteria, its potential staffing, and the food costs therein.

Current bonding potential allows for one major renovation every 20 years. At current state, the high school would not be renovated until 2039, the middle school in 2059, and the primary/intermediate in 2079.

The Trigg County School Board convenes for the first time in 2023 at 6 PM this Thursday. Wade said a contingent from the committee will be present, and with active interest.

Per tax-rates.org, the median property tax for Trigg County in 2023 will be $579 for a home worth $98,300. The sheriff’s office, on average, collects 0.59% of a property’s assessed fair-market value as its property tax.

As such, Trigg County has one of the lowest median property tax rates in the country, and the average yearly property tax paid by county residents roughly equates to 1.25% of the occupant yearly income. Coming into this fiscal year, that’s ranked 2,338th out of 3,143 counties in the U.S.

Oldham County officials collect the highest property taxes in the state, levying an average $2,244 per home on 0.96% of median home value, while Wolfe County has the lowest property tax in the state by collecting an average tax of $293 on 0.54% of the median home value.

Trigg County Schools officials have noted that this recallable nickel would raise an extra $40 annually per $100,000 of assessed property value, meaning a bill of $590 on a $100,000 property would jump to $630 — which equates to a 6.7% increase in payments.

A comparison of west Kentucky school district tax rates can be found here: WestKentuckyTaxRates2023