For businesses currently seeking high-quality employees, finding the right fit can be difficult.

One route to take: hire a soldier transitioning back into civilian life.

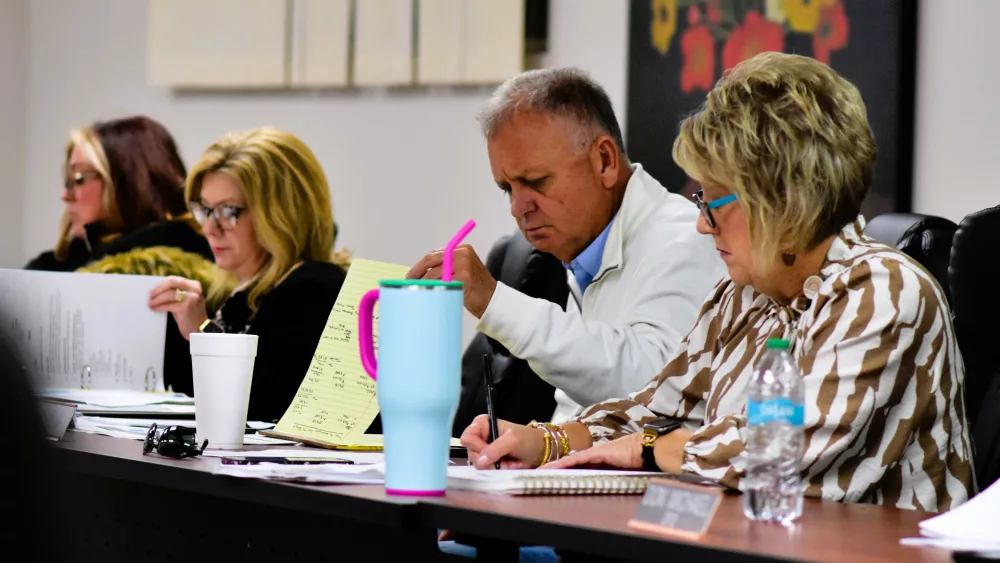

This was the message during Monday’s South Western Kentucky Economic Development Council meeting, when Fort Campbell Garrison Commander Col. Andrew Jordan spoke on behalf of his division.

According to both Jordan and SWK EDC Executive Director Carter Hendricks, more than 400 soldiers transition monthly from active duty to civilian status out of Fort Campbell — or roughly 4,500-5,000 military personnel per year.

And much like Jordan, who admitted he and his family will be retiring in the area once they’re ready, soldiers and their families are opting to stay in and around the Fort Campbell area for specific, family-forward reasons.

Jordan particularly noted that when Hopkinsville’s newest speculation building is completed at Commerce Park I, and — say — a batter-related business bunkers down in the “Batter Capital of the World,” soldiers of all different skill sets could be the target demographic.

He specifically referenced the base’s worker transition program, which was recently dubbed the best in the U.S. Army by President Joe Biden when Fort Campbell was awarded the 2021 Commander in Chief’s Annual Award for Installation Excellence.

From men and women who were enlisted for 3-to-4 years, to those who built 30-year-plus military careers, experience comes ready and available.

Younger enlistees, Jordan said, come with a wide berth of skill — particularly in technology.

Longer-tenured soldiers, Jordan added, bring a unique sense of leadership and regimen.

Garrison senior enlisted adviser Joe Harbour, part of Jordan’s entourage, noted that one of the only things holding Kentucky — and specifically the Trigg, Christian and Todd counties area — back from taking full advantage of this opportunity is the lack of tax abatement for the military.

With Fort Campbell straddling the Kentucky-Tennessee state line, Harbour said military families switching to civilian life — more often than not — opt to live near Clarksville, due to the lack of state income tax.

During 2021 regular session of the general assembly, nine Republican sponsors — including Hopkinsville’s Walker Thomas — introduced a bill to amend KRS 141.019, in hopes to exclude United States military retirees’ pension income from income taxation, for taxable years beginning on or after January 1, 2021 and before January 1, 2025.