School taxes for Christian County residents will be going down after property assessments went up. Thursday night, Public Schools Director of Finance Jessica Darnell told the School Board the current rate is among the lowest of the 171 tax rates in the state.

click to download audioShe adds the property assessment is used by the state to determine how much tax the school system can collect.

click to download audioThe increase in assessment will result in a decrease in SEEK funding, according to Darnell.

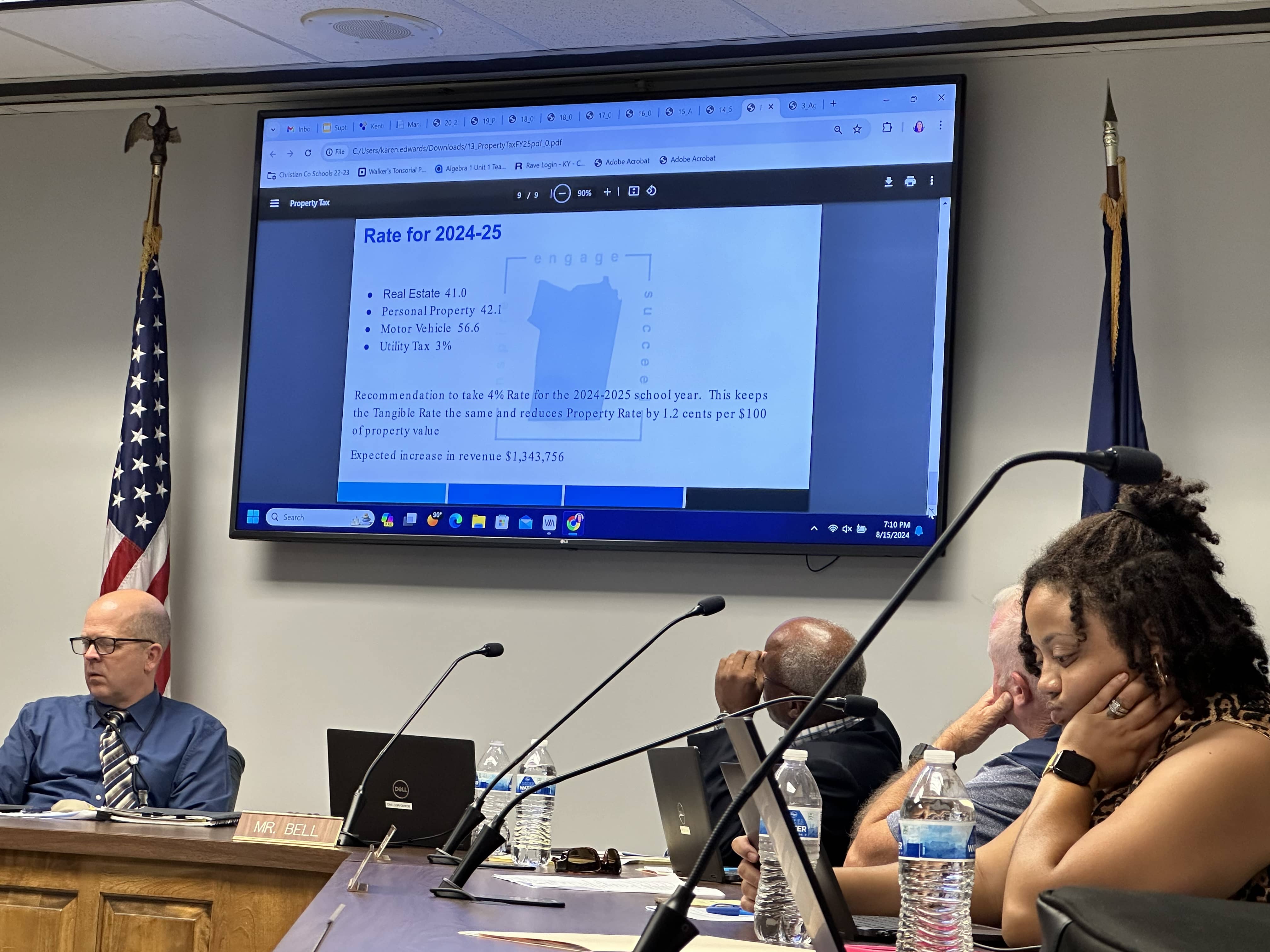

click to download audioThis is a problem every district is grappling with and she says they do not know if there will be relief funding from the state, though the district will apply. Darnell says her office is proposing to take the 4 percent increase allowed by the state.

click to download audioThe School Board voted to approve the tax of .41 cents per 100 dollars assessed value on real property, .421 cents per 100 dollars on tangible property, .566 cents per 100 dollars on motor vehicles, and a 3 percent tax on utilities, with the last three being the same as last year.